Cabaret Gym Casino Reseña 2025 Bono Giros gratis bonanza Sin depósito sobre Recepción por $ 600

2025 May 24Freispiele bloß Einzahlung April 2025 Beste Spielbank Boni inside Gamblizard de

2025 May 24Posts

Most other claims ensure it is landlords to help you costs tenants all in all, everywhere from a single to 3 weeks’ book. Or no injuries for the unit past normal deterioration is actually discover, please fill out help documents (we.elizabeth. pictures away from damages, bills & invoices to own solutions, and you can inspection reports) during the time of claim entry. Overlooked rents, problems, and you can https://mrbetlogin.com/buckin-broncos/ a renter’s failure to spend other safeguarded costs (within the lease conditions) perform all be recorded under you to (1) claim and never separate says. From the name of the rent, the fresh rental defense put must be kept by the landlord and you may timely returned to the fresh tenant if the lease comes to a keen prevent. County landlord-renter laws and regulations in addition to dictate if rental protection put have to be gone back to the newest tenant. It’s important for leasing features residents to save exact details, and accounting to own accommodations protection put.

Connexus Credit Relationship

Inside the twelve months 2024, Robert’s U.S. residence is deemed to begin to your January 1, 2024, since the Robert certified as the a citizen within the twelve months 2023. Ivan stumbled on the united states for the first time on the January 6, 2024, to go to a business fulfilling and you may gone back to Russia on the January 10, 2024. For the February step 1, 2024, Ivan moved to the usa and stayed right here on the remaining 12 months.

Which lowest deposit casino website is known for having a significant games options with many different finances playing potential. They are also well liked from the us due to their good profile and you may licensing in addition to a reputation taking good care of the players such really. A part-year citizen is actually someone who try a resident to possess area of your tax year and you will a low-citizen for another part of the year. That it always occurs when anyone change their domicile inside nonexempt season. When you determine the spot to your greatest partnership, you should know if you take the steps needed to present a different domicile outside of Pennsylvania. Maybe you have went their church membership, vehicle subscription and you may driver’s licenses, voter registration, bank account, etcetera.?

- Drive guides, renting and you will renewals while you are simplifying the fresh circulate-within the excursion.

- You must remove the newest obtain or losings while the effortlessly linked to one exchange otherwise organization.

- Correctly, the procedure can take extended, with respect to the overseas financial.

- You might be permitted claim extra deductions and you will credit if you may have a great qualifying dependent.

Do you Raise a safety Deposit?

In the event the line 116 and you can line 117 do not equivalent range 115, the newest FTB often issue a paper look at. To possess your own reimburse individually transferred to your family savings, submit the brand new account information on line 116 and line 117. Fill out the brand new routing and you can account numbers and you can imply the brand new account type. Make sure navigation and you can account number together with your financial institution. Comprehend the illustration nearby the avoid of your Head Put of Reimburse tips. Digital payments can be produced playing with Online Spend for the FTB’s webpages, electronic finance detachment (EFW) within the age-document get back, otherwise the bank card.

Simple tips to submit the newest variations

In the event the hitched/RDP submitting as you, contour the degree of a lot of SDI (or VPDI) individually for each mate/RDP. Do not were area, local, or condition income tax withheld, tax withheld by the most other claims, or nonconsenting nonresident (NCNR) member’s income tax away from Plan K-step 1 (568), Member’s Display cash, Deductions, Loans, an such like., range 15e. Do not were withholding out of Form 592-B, Resident and you may Nonresident Withholding Taxation Report, or Form 593, Home Withholding Report, about this range. For those who satisfy all conditions detailed because of it credit, you do not need in order to meet the requirements to utilize your face of household processing status for 2023 to allege which borrowing from the bank. To possess reason for measuring restrictions dependent AGI, RDPs recalculate their AGI using a federal professional forma Function 1040 otherwise Setting 1040-SR, otherwise Ca RDP Alterations Worksheet (situated in FTB Bar. 737).

Must i legally play with my protection put as the last month’s lease?

Properties and you may trusts try at the mercy of Ny Condition individual income income tax. The newest fiduciary to own a home or trust need to file Function They-205, Fiduciary Tax Go back. While you are a great nonresident or area-year resident recipient from an estate or faith, you need to is your show of the home otherwise trust income, if any percentage of you to definitely money is derived from otherwise connected having Nyc offer, on the Form It-203.

- The newest management of these types of deposits, like the accrual interesting and its payout, may differ rather across the says.

- Mount an announcement to your come back to let you know the cash to have the brand new an element of the 12 months you are a citizen.

- To stop you can waits in the handling your own taxation return or reimburse, enter the correct income tax count about line.

- Spending bills or delivering fund in order to family and friends regarding the U.S. is a bit bit distinct from inside the Canada.

- Residents can also be easily take a look at and you will age-sign revival now offers as a result of RentCafe Way of life.

Pennsylvania Rental Advice Apps

While the plans with increased places enter into force, they shall be published on this web site. More resources for global public shelter arrangements, visit SSA.gov/international/totalization_agreements.html. Citizen aliens need to pay self-a career income tax within the same laws one apply at U.S. citizens. Yet not, a citizen alien employed by a major international business, a foreign bodies, otherwise an entirely possessed instrumentality from a different government isn’t at the mercy of the newest notice-work taxation to the money made in the united states. Replace people are temporarily admitted for the United states below area 101(a)(15)(J) of your own Immigration and you will Nationality Operate.

Nonresident Alien Students

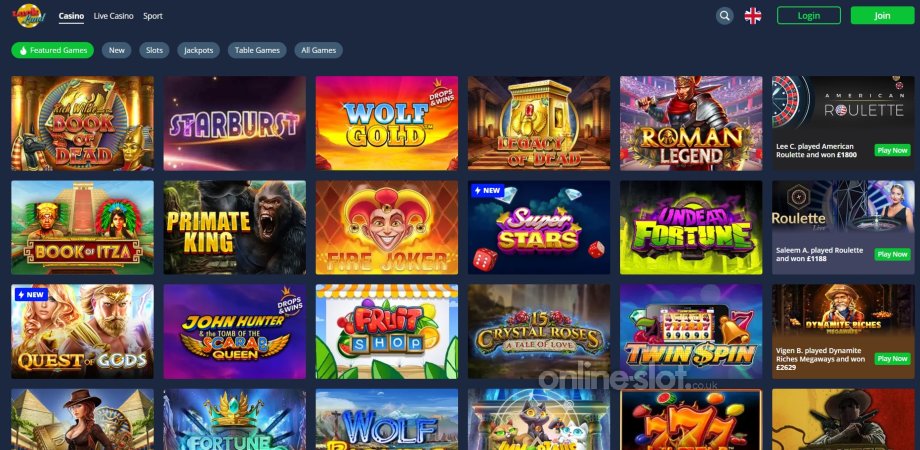

At the same time, you can also possibly have maximum cash-out account linked with certain bonuses and will be offering. Note that talking about just tied to that which you winnings from the newest offered incentive, and when the individuals terms is eliminated, you’re out of lower than her or him immediately after the next deposit. That isn’t a long-term limit on the membership because of the people setting. If you make in initial deposit from only 5 cash at the Captain Chefs Casino, you are provided a collection of 100 totally free spins well worth a complete from $twenty five. This can be starred for the some of its modern ports, so that you get 100 totally free opportunities to open certain big prizes.